Fitting a trade to customer's wish

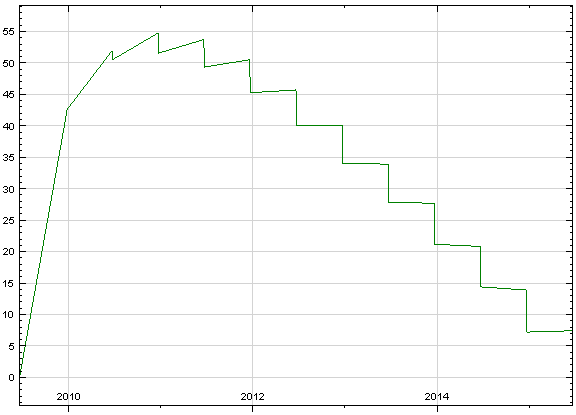

MarketSimulator is handy when one needs to modify a trade and check how the counterparty exposure changes. Suppose we have a corporate customer who wants to protect herself from rising interest rates. She would like to enter a swap with us; we will pay floating rate, the customer will pay fixed rate. MarketSimulator calculates the exposure profile of this swap:

We see that the peak potential exposure is 55. As we have no collateral agreement with the customer, we require that the customer posts an upfront margin (also known as independent amount) to protect us from losses if the customer defaults. The customer will receive the margin back at the end of the trade, but she is still unhappy with the fact that she won't be able to use this cash until the end of the trade. She wants to lower the independent amount.

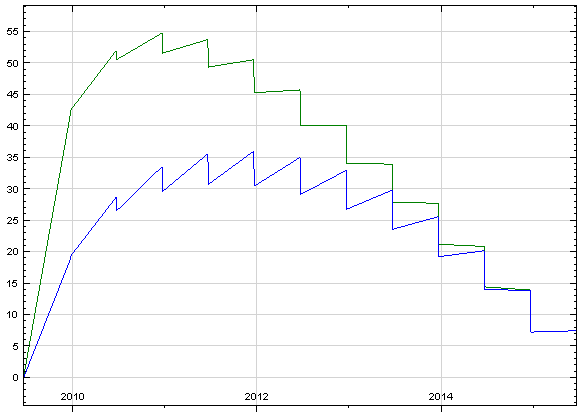

The structurer's job is to find a solution that would satisfy the customer without exposing us to more credit risk. The structurer proposes to add another trade, a cap, and cover the swap and the cap by a netting agreement. The cap is on the same notional as the swap; if interest rate raises above 7%, the customer will pay us the difference. MarketSimulator calculates the exposure for the new trade (blue graph), and we compare it to that of the original swap (green graph):

We see that the peak exposure on the new trade is 36, so the upfront margin can be set lower than before. Of course, by entering the cap the customer gave up some of her protection against high interest rates: for example, if the rates raise to 8%, she will have to pay 1% to us. However, if she has an opinion that such high rates are unlikely, she will probably accept the tradeoff for lowering her upfront margin.

MarketSimulator allows the structurer to instantly visualise how changes in the portfolio affect the exposure and demonstrate it to the customer, speeding up negotiations.